Can you claim depreciation on your building?

A major tax difference between commercial and residential buildings is that you can claim depreciation on commercial buildings.

Depreciation for buildings was removed across the board in 2010, then reinstated – but only for commercial buildings – as part of a 2020 emergency pandemic support package.

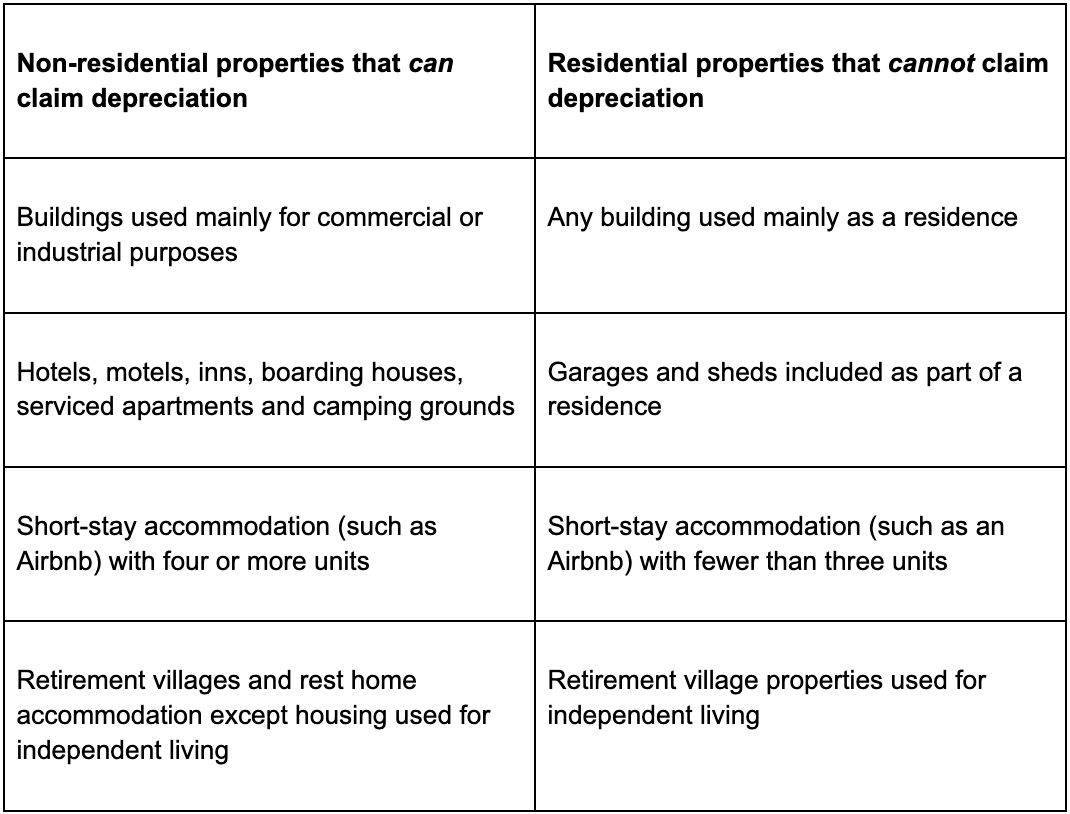

Residential landlords cannot claim depreciation, but there are some grey areas where it’s not immediately obvious whether a building is residential or not. Inland Revenue has recently released a fact sheet to help you find the right depreciation rate for your building.

Does your property qualify as non-residential?

Here are the criteria according to the Fact Sheet ➡️

Claiming depreciation can save you a considerable amount. For instance, IR provides an example of a motel building with a tax book value of $3 million.

The depreciation rate of 2% means the company can claim a $60,000 deduction, paying $16,800 less tax. If your building is non-residential, you can also depreciate the fit-out.

Questions about depreciation?

We can answer your questions about depreciation on your building, your fit-out or various tax deductions on any properties. Get in touch, we’d love to hear from you.